37+ interest only mortgage pros and cons

During the interest-only phase of an interest-only mortgage monthly payments are typically lower. With an interest-only mortgage you pay only the interest on the loan for a set period.

First Time Home Buyer Programs Loans And Grants

Ad These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank.

. Skip The Bank Save. Web There are some potentially powerful pros to opting for an interest-only mortgage when buying a house. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

This is because you are only required to pay. This is the amount of money you are borrowing. Web An interest-only mortgage has a fixed or adjustable rate.

It also has a set repayment timeline such as 15 or 30 years. 4 100 004. Web With an interest-only mortgage you initially only pay the interest on the loan typically in the first five or 10 years.

A 40-year mortgage may offer the benefit of a lower monthly payment because its a long-term loan. This is the amount of money you are paying to borrow usually a percentage of the overall sales. Lock Your Rate Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Having a mortgage and making regular monthly payments can help improve or maintain your credit score. Apply Get Pre-Approved Today.

Web Heres how you would calculate your interest-only payments if you take out a 100000 interest-only loan at 4 APR. Web A key difference is that monthly payments on interest-only mortgages are much cheaper than repayment mortgages. Web The Bottom Line.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Initially you only pay interest. Offers rewards program and unemployment.

Web Benefits of having a mortgage. The advantage is that these initial payments are. Lower monthly payments which can.

No doubt the idea of keeping your mortgage payments to the bare minimum is attractive. 2000 on-time closing guarantee. Web Pros and Cons of Interest-Only Mortgages Pros.

These Well-Reviewed Savings Accounts Earn More Interest Than The National Average. With a conventional home loan youd make payments towards the interest and. But there are some downsides and risks to going this.

Save Real Money Today. 004 12 00033333. Get Pre Approved Online Today.

Web Pros and cons Pros Down payment as low as 3 for first-time homebuyers. Ad 10 Best Home Loans With Interest Only Zero Down Payment. Ad Compare the Best House Loans for March 2023.

Web The interest is the money you pay the lender for allowing you to borrow. Web Pros and cons. Web Interest-only loan pros and cons Pros Requires low initial monthly payment.

Youll also have flexibility because of the. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Cons Of Interest Only Mortgages

Should You Get An Interest Only Or Repayment Mortgage Money Co Uk

Interest Only Mortgage Pros And Cons Freeandclear

Agenda

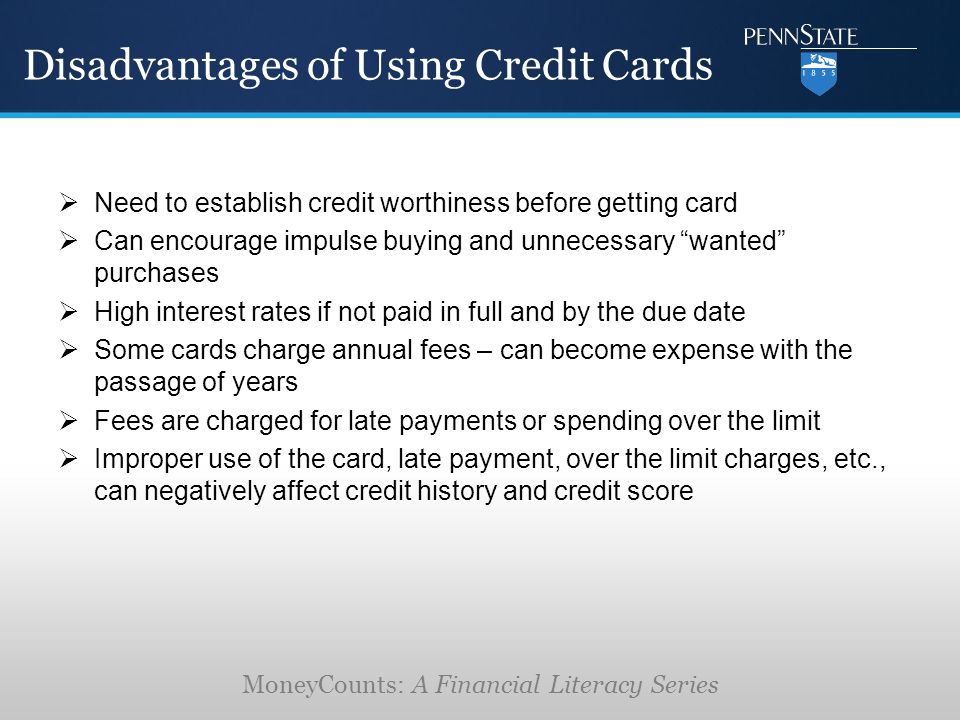

Moneycounts A Financial Literacy Series Ppt Download

Repayment Vs Interest Only Mortgages The Pros And Cons Rfb

Should You Get An Interest Only Or Repayment Mortgage Money Co Uk

Interest Only Vs Repayment Mortgages Buy To Let Guide

Should You Get An Interest Only Or Repayment Mortgage Money Co Uk

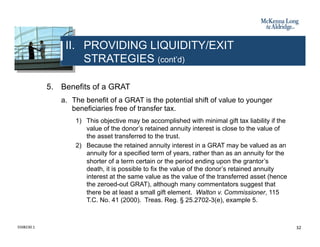

Business Succession Planning And Exit Strategies For The Closely Held

Different Types Of Mortgage Loans

Would You Take An Interest Only Mortgage

Benefits Of An Interest Only Mortgage Loanbase Com

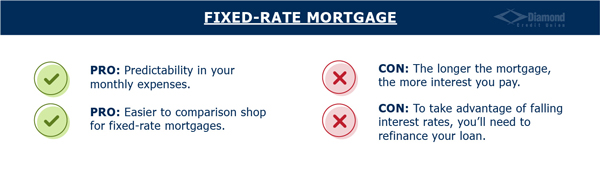

Which Types Of Mortgages Are The Best Infographic Diamond Cu

Pros Cons Of An Interest Only Mortgage Loan

Would You Take An Interest Only Mortgage

Pdf Towed Diver Surveys A Method For Mesoscale Spatial Assessment Of Benthic Reef Habitat A Case Study At Midway Atoll In The Hawaiian Archipelago